- March 30, 2023

- Information, News

- No Comments

The time has come to face this head-on, and I am not referring to your dentist appointment. The ULA transfer bill, better known as the “Mansion Tax” is here, and it will begin taking effect on April 1, 2023, on all sales exceeding 5 million dollars in Los Angeles City. What makes this transfer bill different from other bills? Grab some coffee, and let’s dive in…

What is the ULA Bill “Mansion Tax”?

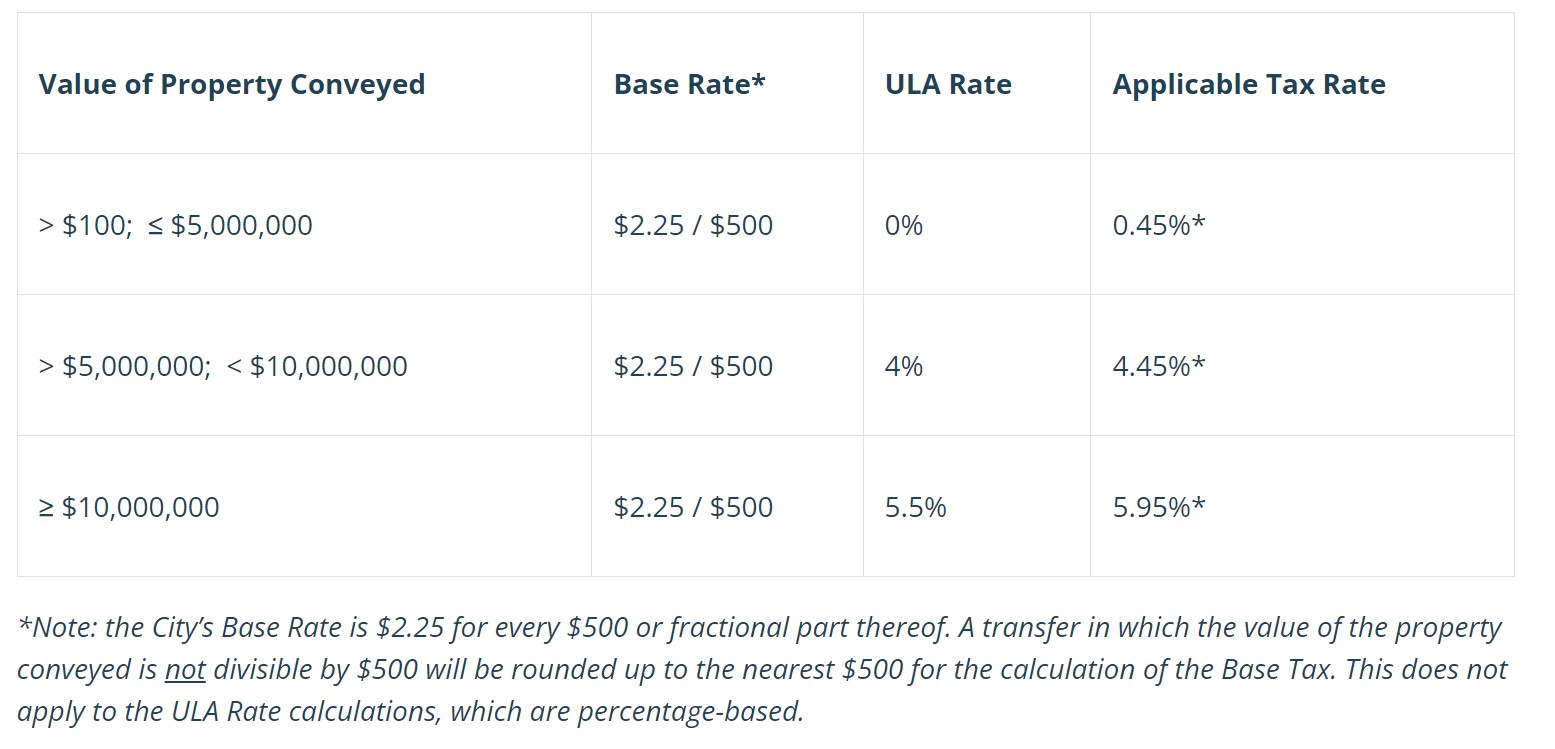

Measure ULA was voted in by Los Angeles residents to tax ALL market-rate real estate sales of $5 million or more within Los Angeles City (5.95% over $10 million). Typically, a real estate sale requires multiple escrow fees at closing, known as “closing costs .” Two fees, usually the owner’s responsibility, are the city and county transfer taxes. The transfer fees exclude the value of any liens or encumbrances (i,e. loans, mortgages, etc.). However, this new ULA bill differs as it imposes a transfer tax on the entirety of the sale value, regardless of whether the property was sold at a gain or a loss.

To use real numbers, the chart below shows the changes in rates provided by the Los Angeles Office of Finance:

If you were to do a simple math calculation, a $5,000,001 property sale would generate a city transfer tax of $22,500+/- under the old rate, in comparison to the new transfer tax rate for the same sale amount would create a city transfer tax of $222,500 +/-. That’s a whopping 888% increase.

In addition, there are certain exemptions from the tax that do not apply to the existing documentary transfer tax, including exemptions for transfers to certain non-profit entities and to certain community land trusts and limited-equity housing cooperatives that, subject to certain exceptions, demonstrate a history of affordable housing development and/or affordable housing property management experience.

Where are the funds going?

According to the bill, the ULA Tax will be used to fund affordable housing projects and provide resources to tenants at risk of homelessness. Proponents of the bill suggested we will create about 26,000 new affordable housing units over the next decade. The ULA measure was set to generate about $900 million annually, based on real estate sales volume from mid-2021 through mid-2022. A UCLA report in September said the taxes would raise $923 million. According to the City of Los Angeles Administrative Office (CAO), which conducts financial budget analyses, the new numbers are 25% less than initially estimated. The Real Estate market is at a standstill with rising rates by the Federal Reserve, and we are expecting fewer transactions due to the higher cost of borrowing money.

According to a report by SCANPH and LAHD at the Implementation Stakeholder session, ULA measure funds are distributed into five funding buckets.

22-25% Multifamily Affordable Housing

22-25% Alternative Models for Affordable Permanent Housing

10% Acquisition & Rehab of Affordable Housing

5% Program Stabilization Fund

Is this bill the answer to our housing shortcomings?

It is hard to know the full impact of the new transfer tax. Once it goes into effect, Measure ULA is expected to generate millions of dollars in annual revenue, or will it be just another fumbled program by the City of Los Angeles? Critics have expressed skepticism over how effective the new tax will fix the homelessness crisis. Prior measures, like HHH passing in 2016 and Linkage Fees passing in 2018, were created to address this issue but have not fared well with the media or shown the results they set out to accomplish.

RAND Corporations led a study in 2021 on Proposition HHH – a $1.2 billion bond to spur the development of up to 10,000 units of permanent supportive housing for people experiencing chronic homelessness. The HHH proposition had labor agreement parameters that added roughly 15% (fifteen percent) to construction costs on affected projects. Units were projected to cost $400 thousand per door to develop and exceeded that number by an astonishing $600 thousand per door. Hence, HHH had a significant effect; it incentivized smaller development to avoid labor agreements. Of roughly 100 HHH-funded projects, more than 45% (forty-five percent) fell into the range of 50 to 64 units of housing, just below the threshold where the measure would have mandated union labor agreements. ULA has doubled down on these project labor agreements by lowering the threshold to just 40 units. As a result, we may see smaller projects for those builders looking to save on construction costs. However, it’s worth noting that all HHH and ULA-funded projects must pay union-level or “prevailing wages adding approximately 10% to per unit costs.

Another criticism of the new law is that it could have a chilling effect on sales of residential and commercial properties in the City of Los Angeles, driving potential developers or investors outside the city limits where the new tax will not apply. The supply due to the rising rate of borrowing money has affected the supply of listings of properties, and this measure may cause a smaller pool of listings in that $5M+ range. We have already seen a departure by many investors and developers choosing to build and invest in other jurisdictions outside of Los Angeles City boundaries to avoid stiff development costs and rent control laws.

There are also several unknowns regarding how the City of Los Angeles will interpret specific provisions of the measure. For example, it is unclear whether the new law will apply to current exceptions to documentary transfer tax, such as foreclosures or deeds-in-lieu of foreclosures. Additionally, it remains to be seen whether the City would permit transfers of separate interests in real estate (land and building structure) or splitting multi-parcel properties into individual transactions to fall below the $5 million and $10 million thresholds.

What are your thoughts? Do you think Measure ULA will be the answer to our housing problem in Los Angeles?

Sources:

1) https://unitedtohousela.com/app/uploads/2022/05/LA_City_Affordable_Housing_Petition_H.pdf

2) https://therealdeal.com/la/2023/03/21/la-cuts-revenue-projections-from-new-transfer-tax-by-25/

3) https://westmount.com/measure-ula-real-estate-transfer-tax/#:~:text=Login%20Client%20login-,Measure%20ULA%3A%20A%20New%20Tax%20on%20Los%20Angeles%20Real%20Estate,into%20effect%20on%20April%201

4) https://finance.lacity.org/faq/real-property-transfer-tax-and-measure-ula-faq

5) https://clkrep.lacity.org/onlinedocs/2022/22-1100-S2_ord_187692_1-1-23.pdf

6) https://www.gibsondunn.com/measure-ula-new-transfer-tax-on-los-angeles-residential-and-commercial-real-property-sales-over-5-million/

7) https://www.latimes.com/california/story/2023-03-27/los-angeles-mansion-tax-owners-sell-homes

8) https://therealdeal.com/la/2023/02/07/kilroy-realty-backed-ballot-initiative-aims-to-shoot-down-measure-ula/

9) https://www.rand.org/blog/2022/11/measure-ula-reflects-the-wrong-lessons-from-proposition.html