- February 12, 2024

- Information, Media, News

- No Comments

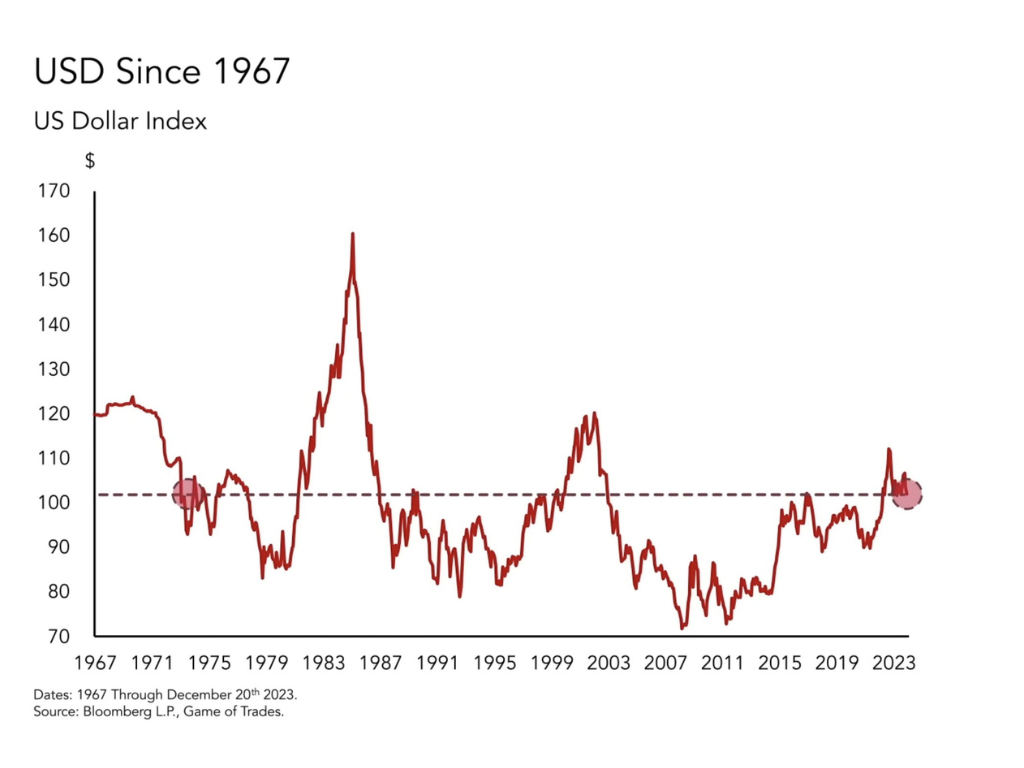

Although the U.S. dollar has maintained a stable exchange rate over the past 50 years, it has gradually lost value compared to most goods and assets in the long term, primarily due to the impact of inflation. Based on the Federal Fund Rate data through December 30, 2023, the full-year average was approximately 5.25 to 5.50%. This means, with inflation at 5.50%, every $100 you have today will only buy $94.50 worth of goods in a year. Over time, this seemingly small difference adds up to a significant decline in your purchasing power. If your investments fail to outpace inflation, it’s like taking a hidden tax on your capital.

Commercial real estate investments historically outperform inflation, making it a preferred choice for savvy investors focused on capital preservation. During inflationary periods, rents tend to increase as the cost of ownership rises, prompting landlords to strategically pass on the expenses to tenants as a hedge against inflation. This aspect of commercial real estate highlights its resilience and attractiveness as an investment option. Leverage the expertise of a local broker who can identify high-performing commercial properties in up-and-coming areas with favorable economic factors like population growth, job creation, and infrastructure development. Focusing on established economic hubs with stable demand and limited supply can also offer opportunities for value appreciation

Here are some resources for further information:

Bureau of Labor Statistics: https://www.bls.gov/: https://www.bls.gov/

Consumer Price Index (CPI): https://www.bls.gov/cpi/

Personal Consumption Expenditures (PCE) price index:

https://www.bea.gov/data/personal-consumption-expenditures-price-index: https://www.bea.gov/data/personal-consumption-expenditures-price-index

Written by:

Frank Soboleske

Senior Associate

Vinco Vinco Realty Group